Introduction to Budgeting

Creating a budget is an important step in managing your finances. It can help you track your spending and ensure that you are saving enough for your future. According to the U.S. Bureau of Labor Statistics, the average household spends about $57,000 a year on necessities and discretionary items. With proper budgeting, you can make sure that you are staying within your means and not overspending on items you don’t need. In this article, we will discuss some tips on how to create a budget that works for you.

Set Financial Goals

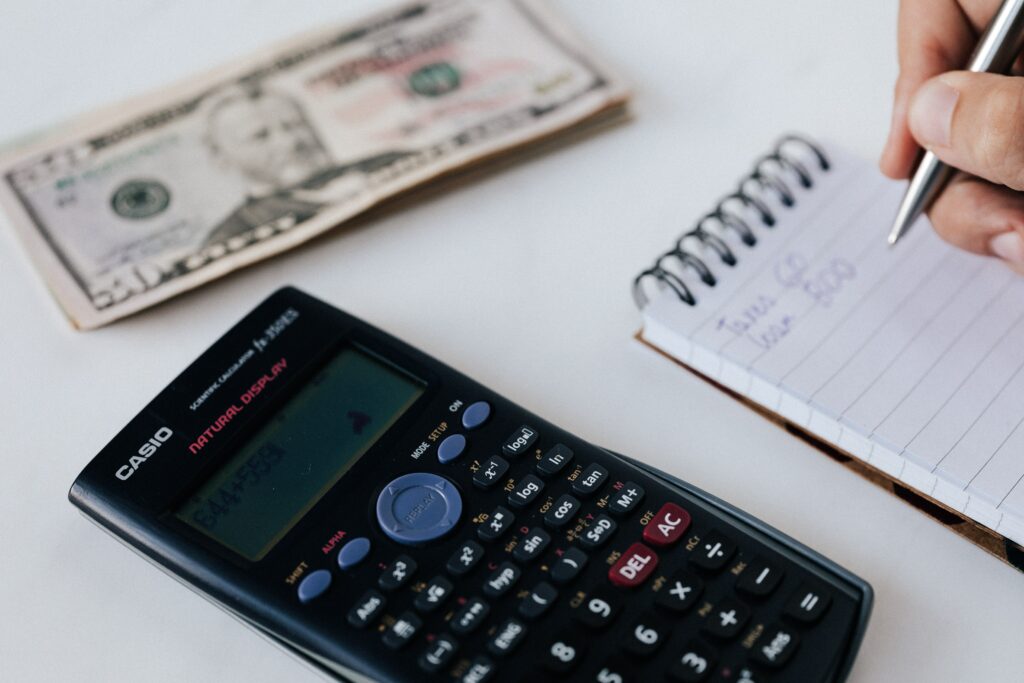

Setting financial objectives is the first step in making a budget. Consider the goals you have for your budget. Do you want to increase your retirement savings? Do you intend to settle your debt? You can stay on track and ensure that you are achieving your financial goals by setting financial goals. To make sure you are making progress, make sure to write down your goals and periodically review them.

Track Your Spending

You need to keep track of your spending after you’ve established your financial objectives. Analyze your credit card and bank statements to classify your spending. To keep track of your spending, use a spreadsheet or a budgeting app. As a result, you’ll have a better idea of how much you’re spending in each category and where your money is going. Look for areas where you can reduce your spending and increase your savings.

Create a Budget

Now that you have an idea of where your money is going, it’s time to create a budget. Start by setting a monthly income goal. This should be an amount that you can realistically save each month. Then, set up categories for your expenses, such as rent, utilities, groceries, entertainment, and savings. Assign a percentage of your income to each category and make sure that you are not overspending in any area. This will help you stay within your means and ensure that you are meeting your financial goals.

Stay on Track

Following the creation of your budget, it’s critical to follow it. Regularly check to see if you are staying within your budget. Make changes to your budget if you find that you are overspending in some areas. You can accomplish your financial objectives and stay on track if you do this. To track your spending and manage your budget, you can also use budgeting apps.

Conclusion

Creating a budget is an important step in managing your finances. It can help you track your spending and ensure that you are saving enough for your future. Make sure to set financial goals, track your spending, create a budget, and stay on track. With proper budgeting, you can make sure that you are staying within your means and not overspending on items you don’t need. With these tips, you should be able to create a budget that works for you.